Are your ducks in a row?

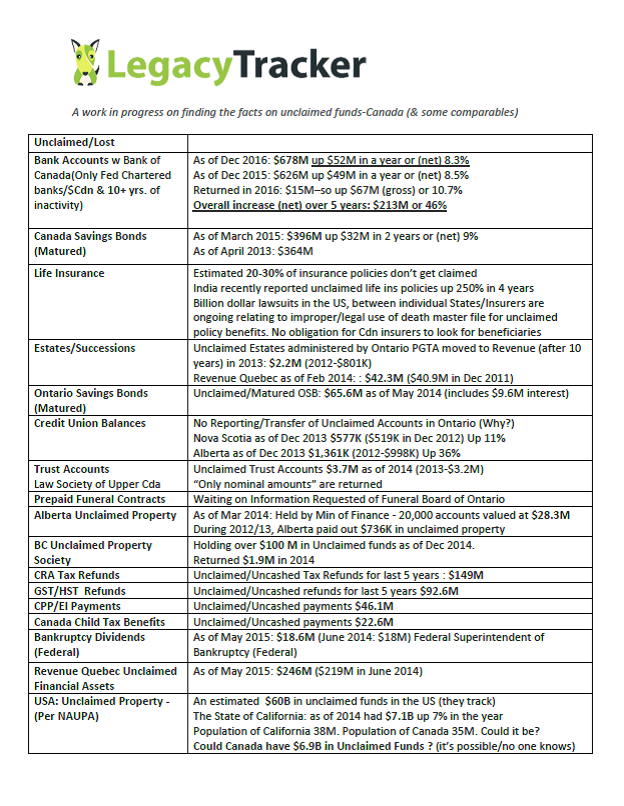

We think $6 Billion in unclaimed or misplaced financial assets in Canada is a pretty good reason for Canadians to get serious about getting financially organized. If you’re not convinced, how about the $66 Billion in the US that is unclaimed despite comprehensive online data bases that exist for searching that we are not lucky enough to have in most of Canada? These lost, missing or unclaimed financial assets were no doubt hard-earned. A good majority of these assets are most likely also tax paid. $70 Billion or so across North America waiting to be claimed by the individual that lost track or the legal heirs of those assets; It’s a lot of money that could make a really BIG difference to many families and loved ones. In Canada it’s not talked a lot about; I liken it to an under the radar economic action plan in waiting.

Unclaimed financial assets come in a variety of forms:

- Bank or Credit Union accounts

- Stocks/Bonds

- Uncashed dividends

- Insurance policies/refunds

- Utility deposits or refunds

- Other prepaids, deposits or refunds

- Trust distributions

- Inheritances

- Annuities/Pensions

- Education funds

- Prepaid funeral contracts

- Mineral royalties such as oil, gas, or mining

- Contents of abandoned safe-deposit boxes

Unclaimed financial assets reside in a variety of places in Canada

- Banks, Credit Unions and Trust Companies

- Insurance Companies

- Share Transfer Agents

- Pension Funds

- Trust monies held by lawyers or real estate companies

- Utilities

- Funeral Homes

- Investment management companies

- Retailers (Gift Cards/Credits)

- Government treasuries or agencies

I know a lot about Unclaimed Financial assets as one of 2 Canadian experts and advocates for Unclaimed Property Legislation. In truth, it’s a bit of an obsession for me that 1) Canadians are losing track of their financial assets and 2) Canada is so way behind in legislating such important consumer protection that already exists in most developed nations like the US, Europe, Australia, New Zealand and even Kenya. It’s also surprising given that no one loses track of their assets on purpose; typically it’s the result of a tragic event or a death or forgetfulness particularly with the rise in longevity that comes with forgetfullness or dementia. By comparison, each individual US state has had such legislation in place for more than 50 years and the majority of those provide an online database that can be searched for the benefit of individuals and/or their heirs. Each state is fairly proactive in returning such assets to their legal owners. Sadly, the same can not be said for Canada because despite how socially progressive Canada might be in many other areas, only 2 provinces in Canada (Alberta and Quebec) have comprehensive unclaimed property legislation in place and provide searchable databases. BC has a voluntary, less comprehensive system in place.

Bank of Canada.jpg

One of the only national databases Canadians can search for unclaimed funds is the Bank of Canada Unclaimed Balance Registry The Bank of Canada has over $1 Billion in Unclaimed financial assets in the form of Unclaimed bank accounts and Unclaimed/Matured Canada Savings Bonds. The registry and database exists because federally regulated banks are required to transfer bank accounts that have had no activity for 10 years to the Bank of Canada by December of each year. While there is a searchable database available online for unclaimed bank accounts which total over $678 Million, there is no such database for Unclaimed and matured Canada Savings Bonds which total over $500 Million. Right now, I’m probably the only Canadian checking these registries each day, awaiting the update for 2017! It may be more surprising for Canadians to learn that no one from the Bank of Canada is looking for legal owners of any of these assets. We know because we asked; they said it’s not their job.

The amount of unclaimed financial assets is a staggering amount and so too is the rate of increase of financial assets becoming lost or unclaimed. The Unclaimed Bank account balance with the Bank of Canada increased by a net amount of $52 Million in 2016 or almost 11 % making for a 5 year (net) increase of $213 Million. So, the only answer most especially for Canadians who do not have consumer protection in the form of comprehensive Unclaimed Property Legislation in place across the country is to …

Get your Ducks in a row

These alarming increases in unclaimed financial assets in combination with a lack of comprehensive unclaimed property legislation for a majority of hard working Canadians and their families should be sufficient evidence of the need to safeguard and protect information relating to financial assets appropriately. No one will safeguard your financial assets and eventually your financial legacy as well as you can. So please do.

You can be certain that given my particular interest in this topic, I make sure that clients have a list of all of their financial assets and information available should a “What if” scenario happen. Please let me know if you would like to learn more.

For those that are interested, I thought I would provide a small glimpse of the problem in Canada. If you are interested in learning more, please reach out but please also take the time to safeguard the information relating to your financial assets.