Repaying CERB (Canada’s Emergency Response Benefit)

This is a confusing time to be sure. The Canada Emergency Response Benefit (CERB) was announced back in March as part of the plan to address the needs of Canadians who had suddenly lost their income as a direct result of COVID19. Easily accessible, easily administered and changed several times to expand eligibility. Some 10 milllion […]

COVID19 Measures for Individuals & Families – Updated to May 15/2020

Here we are in Week 4 of an upside world that has sideswiped most of us. Since mid-March, restrictions and measures related to COVID-19 have rapidly escalated. While the first stages focused on public health and safety, in very short order, businesses and personal finances began to be affected. It is clear that these challenges […]

30 Good reasons to Open a CRA My Account ASAP

“My Account” for individuals is Canada Revenue Agency’s (CRA’s) online service portal which allows Canadian taxpayers to access their personal income tax and benefit information quickly and easily. It also allows taxpayers to manage many of their personal tax matters online, 7 days a week/21 hours a day. If this service had been available when tax was a large […]

Unprecedented times call for Unprecedented Measures (COVID-19)

Unprecedented and Uncertain times call for unprecedented action on the part of all levels of Government. Here is a summary of the measures announced this week by the Federal Government (March 18/20), Please reach out and connect if I can help you understand your financial situation and which measures may help your personal situation Personal Tax […]

Stay Calm and Carry on? (Yes)

The Roller coaster ride continues Week 2 Prior to the middle of February of this year, markets were on a real tear, climbing to record 15-year highs. However, equities dramatically declined last week amid a large spike in volatility as fears that the coronavirus would turn into a global pandemic rattled all markets. Many investors […]

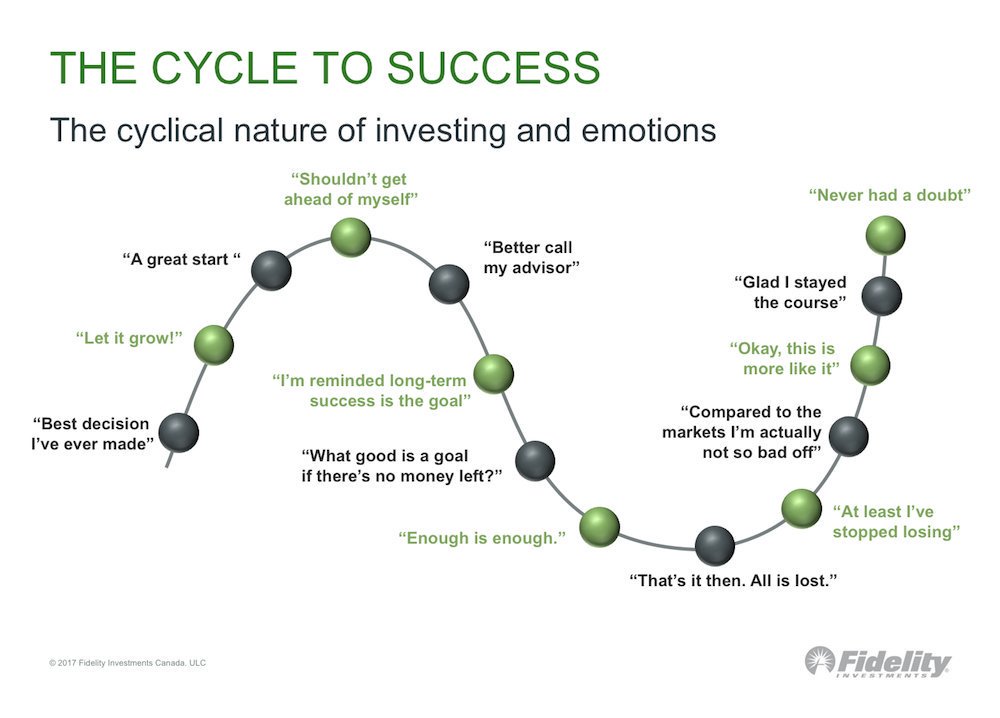

11 things to keep in mind this week about the market

Markets tend to revert to their average performance over time. It’s been quite a week so far as markets (and the media) have been rattled by the financial impact of the Coronavirus which reminded me of this graphic from Fidelity that I found in my files and thought I would share. Life on the financial […]

Incorporation Now, Later or Never?

There comes a time when many (if not all), entrepreneurs wrestle with the decision of whether or not to incorporate. There can be many advantages to incorporation but it’s important to determine if all those advantages will actually benefit you and your business. Sometimes, it’s too early to incorporate. Hopefully this blog will help you […]

Responsible Investing Makes Sense

Putting your money where your value are! Responsible investing (RI) is about incorporating environmental, social and governance factors (ESG) into investment decision making with the goal of generating sustainable value for investors, shareholders, stakeholders and for society in general. Making Money while Making a Difference Responsible investing (RI) is an umbrella term that includes a […]

Last minute year-end tax planning tips

According to a CIBC poll, 77% of Canadians don’t think about their taxes until Dec. 31 or into the new year which is the reason why so many Canadians miss out on tax saving opportunities. But it’s the start of December so there is still time to put some tax savings options into place! Here are […]

10 REASONS TO OPEN A REGISTERED DISABILITY SAVINGS PLAN (RDSP)

Happy 10th Anniversary to the Registered Disability Savings Plan – If only more knew about you ! Registered Disability Savings Plans (RDSPs) have been available to Canadians who qualify for the disability tax credit since 2009. They were introduced primarily to help alleviate the concern that many parents and grandparents of a child with a […]

Top Age Friendly Tax Tips for Canadians

I can’t believe it’s that time again ! The older you get the faster another tax season seems to be upon us, especially if you’re an accountant! Whether you file your own return or help an older family member or friend, I hope this annual update of my Top Age Friendly Tax Tips will help ease the pain […]

How to make your life with CRA easier and your accountant happy

Access personal tax and retirement information securely online “My Account” for individuals is Canada Revenue Agency’s (CRA’s) service portal which allows Canadian taxpayers to access their personal income tax and benefit information quickly and easily. It also allows taxpayers to manage many of their personal tax matters online, 7 days a week/21 hours a day. If this service […]

Open communication with your partner about your finances will make you happier and more attractive

10 good reasons why Women need a financial plan

The benefits of a written comprehensive financial plan are generally universal for all, but women face unique challenges that make having a financial plan more critical and working with a certified financial planner worthwhile 10 good reasons why Women need a financial plan and financial planning Women are increasingly becoming financial decison makers Whether single, married, divorced […]

11 financial resolutions for 2019

The beginning of a New Year is a great time to reflect on your current situation and set your financial goals for the year ahead especially since there is a direct connection between overall financial wellness or financial peace of mind and happiness. For the record, financial peace of mind does not have to include […]

People who budget have better financial outcomes

Budgets help individuals enhance their financial well-being Budgeting is one of the single most effective tools for money management. It’s an effective way to map out spending to help manage your money and help ensure you will have enough money for the things you really need and the things that are important. A budget or spending plan can […]

Be Boring. Get some Life Insurance.

There’s nothing sexy about insurance I’m going to be perfectly honest. There’s nothing sexy about insurance. Which is perfect because I’m a boring accountant licensed to sell life insurance. Buying life insurance is like admitting you’re a responsible adult. For a younger demographic it’s like the definition of “Adulting”. But the truth is often, insurance should NOT […]

Enhancing Financial Literacy Skills is a good investment

Welcome to November, Financial Literacy Month in Canada Financial literacy is the ability to understand and discuss financial concepts and apply them to your own financial situation. It includes skills like budgeting, paying bills on time, making decisions about financial products, planning for the future and being financially prepared for an emergency. Financial literacy skills are […]

RESPs help you power up and maximize education savings

Given rising education costs, Registered Education Savings Plans (RESPs) are a smart way to power up and maximize education savings. Trust me I know. I am the proud Mom of 2 recently graduated sons. Tuition is just part of the cost of post secondary education. Books, residence fees, activity fees and other living expenses can […]

Segregated funds combine the growth potential of investment funds with added benefits

Segregated funds are like mutual funds but different. They are market based investments which offer professional management, diversification and growth from exposure to stocks and other assets like mutual funds. However, while they may act like mutual funds, segregated funds are insurance products offered by insurance companies and so they come with a built-in insurance […]

10 BIG benefits of Health Spending Accounts

Health spending accounts are a smart way to fund health and dental expenses Health spending accounts are an affordable replacement or a valuable add on to a traditional insured health and dental plans for self employed individuals, business owners and corporations. Health spending accounts (HSAs) provide a pre-determined/fixed but flexible amount of pre tax money to individuals at the beginning of […]

It’s never too late or too early to talk to kids about money

As this infographic from the Money As You Grow website shows, the financial education of kids can’t start too early. However, it’s also never too late to start. This infographic also shows that WHEN to talk to your kids about money is important. Since parents have the most influence on their children’s financial behaviours, the sooner parents start talking about […]

Is there such a thing as “Too much Canada”?

Who doesn’t love Canada eh? But (Sorry) ..this past week has reminded us again that having too much of Canada in your investment portfolio can be a detriment to your long-term savings. That’s because despite good overall economic results in Canada, the performance of Canadian equities in particular have been poor recently. Investing more of your […]

Make digital assets part of your estate plan

Problems in dealing with digital property after the death of a loved are becoming all that more common given the digital age in which we live. Based on the fact that way too many Canadians don’t have an up to date will to take consideration of their financial assets; it’s even more rare to hear of individuals […]

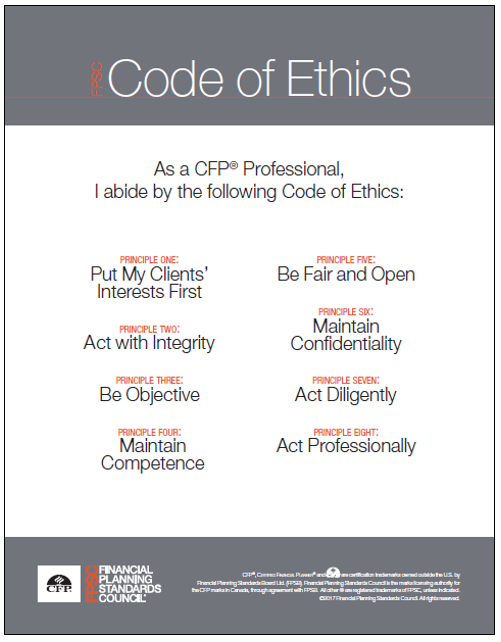

Is your Financial Planner putting your interests first?

Does your financial planner have the knowledge, skills and abilities to navigate all the aspects of your financial life but also have an ethical obligation to put your interests ahead of their own? Across Canada (except in Quebec), anyone can currently call themselves a financial planner without having any qualifications to back it up. Professional […]

6 good reasons to consolidate your investment portfolio

It’s oh so common for Canadians to hold investments at more than one financial institution with or without multiple advisors. So common that there’s a name for it: it’s called “account sprawl” When finncial advisors talk about the importance of “diversification” this is not the kind of diversification we are talking about! Having more than […]

10 ways to spend your tax refund productively and wisely

Tax season is followed in Canada typically by “tax refund waiting season” with the average Canadian awaiting a tax refund of approximately $1,600. For many waiting on a tax refund it’s seen as a windfall or found money but in reality it means tax has been overpaid and money has been lent to the government […]

Why you or a loved one with a disability need an RDSP

The quick answer is FREE MONEY and Tax sheltered savings that don’t impact other social assistance programs or eligibility to other benefits like ODSP in Ontario. Registered Disability Savings Plans (RDSP) were introduced in 2008 as a long term tax deferred savings plan intended to help individuals, parents and others save for the long term financial […]

An RDSP can provide a financial boost to those with a disability

Registered Disability Savings Plans (RDSPs) have been around since 2008 helping Canadians with a severe and prolonged disability, save for their future. RDSPs can be established for those who qualify for the disability tax credit (T2201) offering a tremendous bonus to those eligible in the form of generous government grants, tax sheltered investment growth and flexibility […]

Motherly Financial Wisdom

It’s the 2nd Mother’s Day since our Mom left us 672 days ago (I’m an accountant so I count). She was our family’s superhero for so many reasons (I can’t count). She left us after contracting a hospital infection which lead to a heartbreaking year-long journey; but that’s an entirely different story. Myself and my […]