Stay Calm and Carry on? (Yes)

The Roller coaster ride continues Week 2 Prior to the middle of February of this year, markets were on a real tear, climbing to record 15-year highs. However, equities dramatically declined last week amid a large spike in volatility as fears that the coronavirus would turn into a global pandemic rattled all markets. Many investors […]

11 things to keep in mind this week about the market

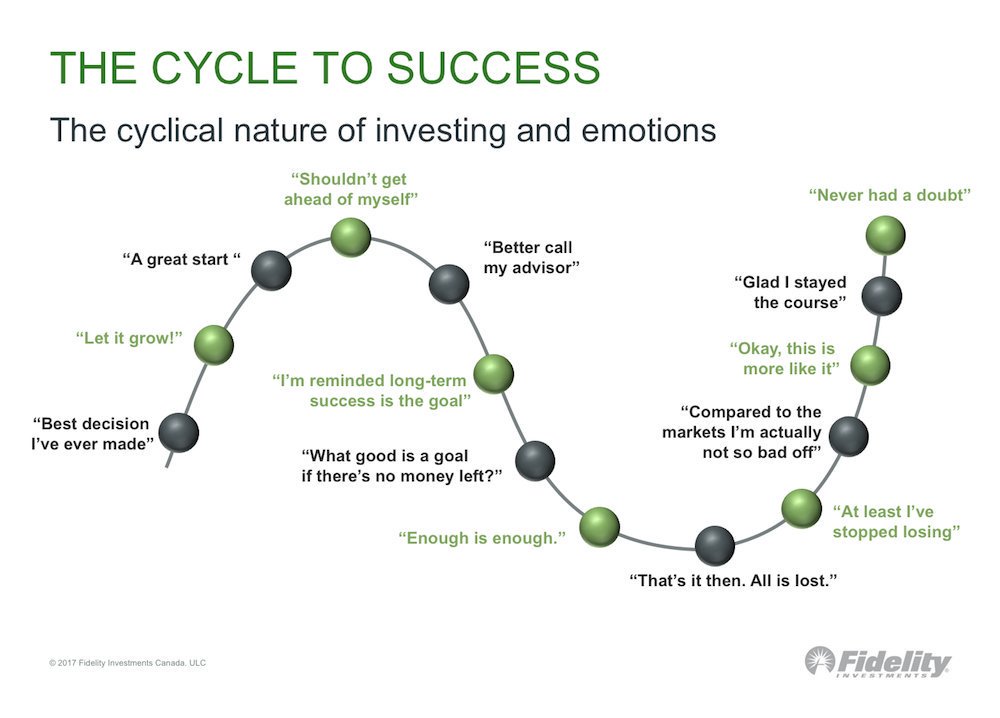

Markets tend to revert to their average performance over time. It’s been quite a week so far as markets (and the media) have been rattled by the financial impact of the Coronavirus which reminded me of this graphic from Fidelity that I found in my files and thought I would share. Life on the financial […]

Responsible Investing Makes Sense

Putting your money where your value are! Responsible investing (RI) is about incorporating environmental, social and governance factors (ESG) into investment decision making with the goal of generating sustainable value for investors, shareholders, stakeholders and for society in general. Making Money while Making a Difference Responsible investing (RI) is an umbrella term that includes a […]

10 REASONS TO OPEN A REGISTERED DISABILITY SAVINGS PLAN (RDSP)

Happy 10th Anniversary to the Registered Disability Savings Plan – If only more knew about you ! Registered Disability Savings Plans (RDSPs) have been available to Canadians who qualify for the disability tax credit since 2009. They were introduced primarily to help alleviate the concern that many parents and grandparents of a child with a […]

People who budget have better financial outcomes

Budgets help individuals enhance their financial well-being Budgeting is one of the single most effective tools for money management. It’s an effective way to map out spending to help manage your money and help ensure you will have enough money for the things you really need and the things that are important. A budget or spending plan can […]

Enhancing Financial Literacy Skills is a good investment

Welcome to November, Financial Literacy Month in Canada Financial literacy is the ability to understand and discuss financial concepts and apply them to your own financial situation. It includes skills like budgeting, paying bills on time, making decisions about financial products, planning for the future and being financially prepared for an emergency. Financial literacy skills are […]

RESPs help you power up and maximize education savings

Given rising education costs, Registered Education Savings Plans (RESPs) are a smart way to power up and maximize education savings. Trust me I know. I am the proud Mom of 2 recently graduated sons. Tuition is just part of the cost of post secondary education. Books, residence fees, activity fees and other living expenses can […]

It’s never too late or too early to talk to kids about money

As this infographic from the Money As You Grow website shows, the financial education of kids can’t start too early. However, it’s also never too late to start. This infographic also shows that WHEN to talk to your kids about money is important. Since parents have the most influence on their children’s financial behaviours, the sooner parents start talking about […]

Is there such a thing as “Too much Canada”?

Who doesn’t love Canada eh? But (Sorry) ..this past week has reminded us again that having too much of Canada in your investment portfolio can be a detriment to your long-term savings. That’s because despite good overall economic results in Canada, the performance of Canadian equities in particular have been poor recently. Investing more of your […]

6 good reasons to consolidate your investment portfolio

It’s oh so common for Canadians to hold investments at more than one financial institution with or without multiple advisors. So common that there’s a name for it: it’s called “account sprawl” When finncial advisors talk about the importance of “diversification” this is not the kind of diversification we are talking about! Having more than […]

An RDSP can provide a financial boost to those with a disability

Registered Disability Savings Plans (RDSPs) have been around since 2008 helping Canadians with a severe and prolonged disability, save for their future. RDSPs can be established for those who qualify for the disability tax credit (T2201) offering a tremendous bonus to those eligible in the form of generous government grants, tax sheltered investment growth and flexibility […]

10 ways to maximize your RRSP success

More than 60 years ago, the federal government introduced RRSPs to encourage Canadians to plan and save for their own retirement in order that they would not rely solely on public or corporate pension plans. As it happens, all these years later, they are more needed then ever. Here are 5 good reasons why RRSPs are a good […]

6 Billion reasons to get your ducks in a row

Are your ducks in a row? We think $6 Billion in unclaimed or misplaced financial assets in Canada is a pretty good reason for Canadians to get serious about getting financially organized. If you’re not convinced, how about the $66 Billion in the US that is unclaimed despite comprehensive online data bases that exist for searching that […]

Open up those investment statement envelopes!

One of my larger complaints while I was in public practice was the amount of unopened mail that would land on my desk during tax season. This included way too many unopened investment statements from clients. Generally, outside of gathering the fees that can be deducted for non-registered portfolios, those investment statements are more useful to […]