Access personal tax and retirement information securely online

“My Account” for individuals is Canada Revenue Agency’s (CRA’s) service portal which allows Canadian taxpayers to access their personal income tax and benefit information quickly and easily. It also allows taxpayers to manage many of their personal tax matters online, 7 days a week/21 hours a day. If this service had been available when tax was a large part of my practice, I am sure I could have completed all those filings on April 29th as this portal can be shared with authorized representatives (including family members and tax preparers) using Represent a Client . No more missing info slips or T1 adjustments for slips that get found only after a tax return has been filed! Technology for Good!

Here’s what you can do and view with CRA’s “My Account”

- View and update your phone and address info or change your marital status

- View the status of your personal income tax returns and refunds

- Change your T1 return

- View and print notices of assessment or reassessments

- View or change a return & submit related documents

- Access and view 10 years of 12 different types of info slips

- View carryover amounts from prior years

- View benefit and credit payments and statements including the child tax benefits as well as GST/HST

- View and update dependent information and apply for Child tax benefits

- Set up reminders for benefits and payments

- View Home Buyers Plan (HBP)/Life Long Learning (LLP) repayments and balances

- View disability tax credit information on file

- Access RRSP contribution receipts

- Access TFSA and RRSP contribution limits

- Set up or update direct deposit information

- Register to receive online mail and email notifications

- Verify that any paper filed returns have been received by CRA

- View/print a proof of income based on prior year assessments

- View and authorize a tax or legal representative

- View installments made

- Request a remittance voucher

- Arrange for direct deposit or update/stop direct deposit

- Submit documents

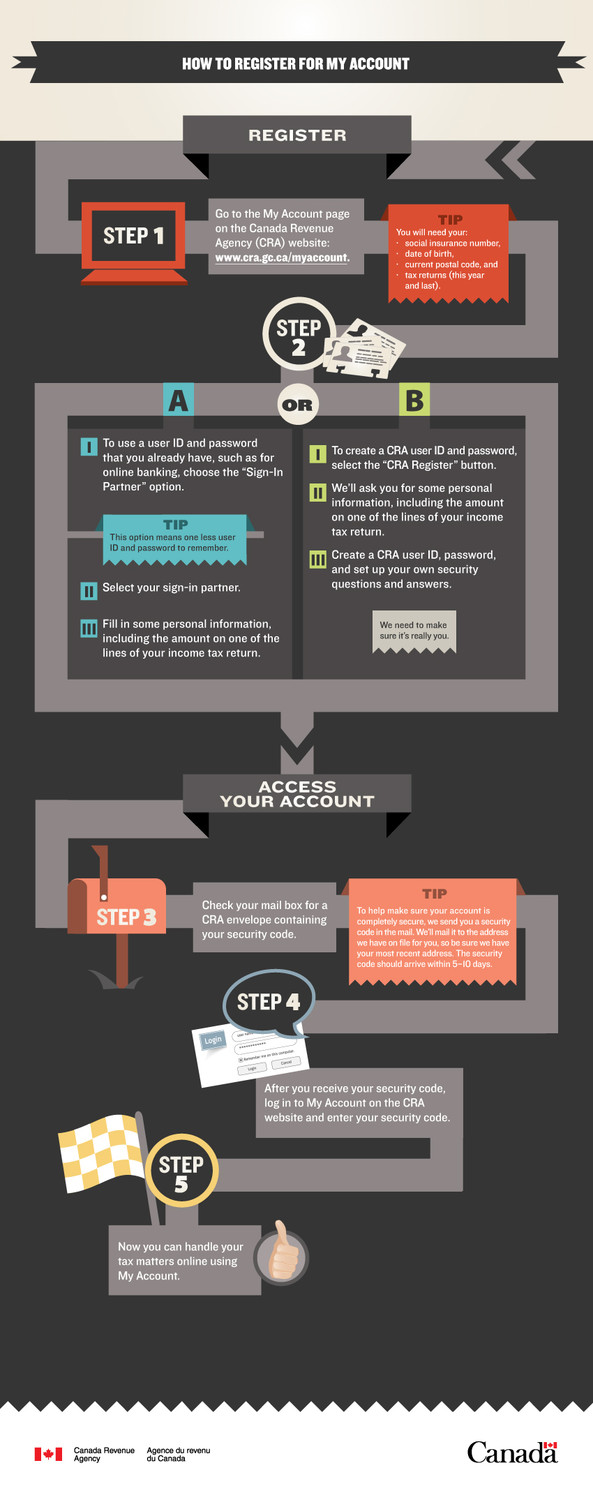

Access to My Account is provided by 2 methods:

- Login with with a CRA user ID and password or

- Login registered “Sign-In Partner” which would be a financial institution that you already deal with online

Using the Sign-In Partner option means you can select the user ID and password that you already use for online banking to also be used with CRA. That’s one less user ID and password to keep track of!

To register for My Account Services you will need to provide some info at hand:

- Your social insurance number

- Your date of birth

- Your current postal code and

- An amount from a line on either your current year tax return or the previous one. The info required from a line on that return will vary.

You can learn more about how to register here

After registering for access to My Account and providing personal information, CRA will mail a personal security code which will allow you to log in to My Account. Most but not all of the services provided by My Account will require the security code. However, even while you await your personal security code in the mail you will be able to access some of the services offered by My Account like your notice of assessment.

Documents like your notice of assessment will be often available online in your account before the official documents from CRA will arrive in the mail. A client was able to access his notice of assessment on his account 2 weeks ago while he is still waiting for the paper copy to arrive in the mail. Paper notices goes through several various processes before it even gets to Canada Post where further delays can occur.

Save some time, energy and future anxiety for both yourself and your accountant by signing up for “My Account” with Canada Revenue Agency.

Your accountant will love you for it.

Sign up for My Account with CRA