Does your financial planner have the knowledge, skills and abilities to navigate all the aspects of your financial life but also have an ethical obligation to put your interests ahead of their own? Across Canada (except in Quebec), anyone can currently call themselves a financial planner without having any qualifications to back it up. Professional regulation is a provincial matter, but has not yet been a priority for most so sadly, without a standard in place for those offering “financial planning” services, it’s really a case of buyer beware. As my association, the Financial planning Standards Council has pointed out for a while, looking for an ethical, professional financial planner is not simply a matter of Googling “financial planner”

Indeed! Many of those offering “financial planning services” could aptly be considered sales representatives particularly those very large institutions with large sales forces who can only sell you proprietary funds (funds their company manage and operate). This would include banks, credit unions, and some large insurance companies and companies like Investors Group. You’ve worked hard for your money, and you should feel confident that the person you chose to help you plan your financial future is not only educated and competent but also ethical and working in your best interest. Those selling proprietary funds only are often also working under the pressure of sales quotas so they would be hard pressed to show that they are working in your best interest. Some of those financial institutions and financial organizations have been working that way for 50+ years. It’s especially hard to change the way they do business despite the fact that the world around them is changing and consumers have a right to expect more.

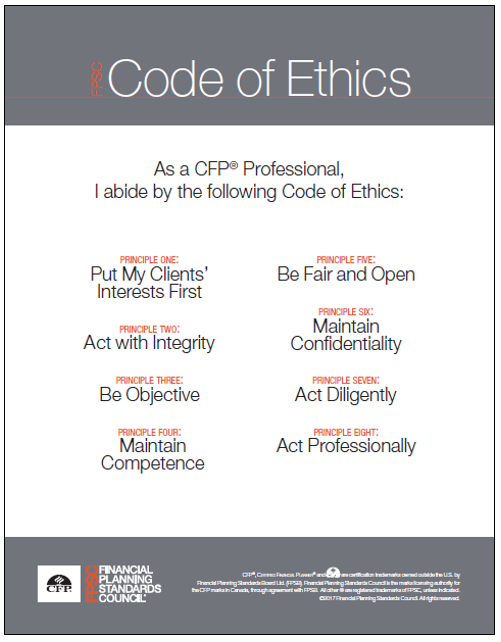

Working with a CFP means adherence (and enforcement) of an 8-point FPSC® Code of Ethics that emphasizes integrity and accountability, to the public, clients and colleagues. CFP practitioners like myself agree to act fairly, diligently and objectively when providing financial planning advice and services, putting your interests first. That’s a prime reason I don’t work for a bank or large financial organization; I work independently so I can serve my customers needs best and first.

I have outlined those 8 principals below. Feel free to use these principals as a measure to find the right professional to help secure your financial future. Ask more questions. Seek good answers.

1. Client FIRST

Top of the list is a written obligation to put clients’ interests first at all times—even if there are differences in compensation for selling one product over another. To maintain certification, every CFP professional must re-attest to this principle annually and agree to be bound by it and accountable.

2. act with INTEGRITY

Trust and confidentiality are cornerstones of integrity. A CFP professional must uphold the principle of integrity at all times, inspiring confidence and upholding a strong moral compass. You’re entrusting your financial future to your planner. It’s only right they be held to the highest ethical standard.

3. Be objective

Objectivity means keeping emotions, personal bias and competing priorities out of the decision-making process. CFP professionals make recommendations based on sound knowledge, strong judgement and a full understanding of their clients’ goals and objectives.

4. MAINTAIN COMPETENCE

It’s not enough to qualify for CFP certification just once in a lifetime. In addition to meeting demanding certification requirements, CFP professionals must keep their skills up-to-date and develop additional knowledge throughout their career. This enables a CFP professional to provide effective advice and service to clients as the financial environment evolves and individual circumstances change.

5. BE FAIR AND OPEN

Fairness is about impartiality and disclosure. CFP professionals must be honest and objective, providing advice and planning without regard to compensation, bias, employer or any other interests. They must also communicate at a level that’s understandable to clients. When you begin working with a CFP professional, he or she will clearly and transparently communicate to you the services to be provided, any potential conflicts of interest they’re aware of, how they’ll be compensated and what you can expect from the relationship.

6. MAINTAIN CONFIDENTIALITY

As electronic data storage becomes more pervasive, the protection of private information is critical. A CFP professional is bound to ensure the protection of all client data regardless of how it is stored or delivered. That includes digital and paper files and correspondence, as well as verbal discussion.

7. ACT DILIGENTLY

Diligence is about being mindful when guiding, informing, planning and delivering financial advice and services to clients. Circumstances can change quickly in your life and the world around you. A CFP professional has the knowledge and ability to

respond effectively to those changes and help motivate you to take actions that will help you reach your financial goals.

8. ACT PROFESSIONALLY

Beyond the expertise required to practice in a field, it’s the high standard of ethics, behaviour and service, and the manner in which the service is delivered, that sets an individual apart as a professional. By following the FPSC® Code of Ethics, CFP professionals hold themselves to a level of professionalism that inspires confidence, respect and trust.

The CFP designation is the mark of a professional that puts clients’ interests first.

Learn more about the FPSC® Code of Ethicsand what it means to you and your financial future.