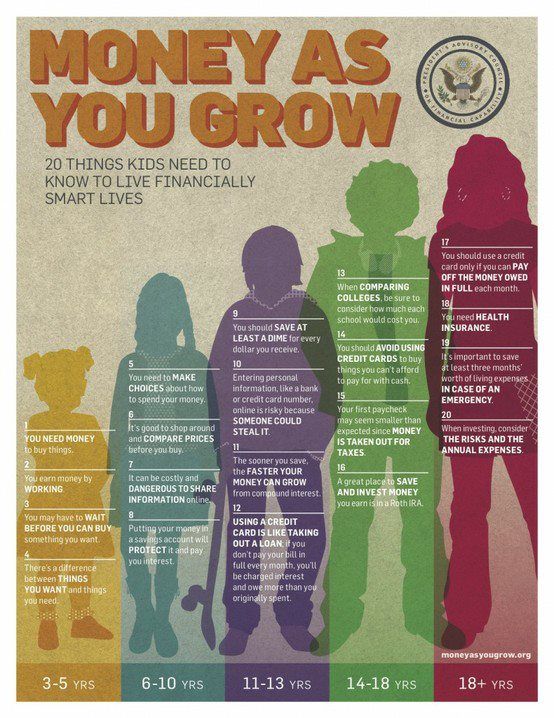

As this infographic from the Money As You Grow website shows, the financial education of kids can’t start too early. However, it’s also never too late to start. This infographic also shows that WHEN to talk to your kids about money is important. Since parents have the most influence on their children’s financial behaviours, the sooner parents start talking about money with their children and taking advantage of everyday teachable moments, the better chance they will have of building skills to live financially smart lives. Reinforcing age-appropriate financial lessons early will help to ensure we raise the next generation to be mindful consumers, investors, savers and givers. That’s good for everyone including our future economy. It’s a very worthwhile investment of time.

Money as you grow

A good Canadian resource for parents and teachers to talk to their kids about financial literacy is www.talkwithourkidsaboutmoney.com This website provides ideas, activities, tools and resources to help engage children in talks and activities about money. Supporting resources are organized by age range – e.g. ages 5-7, ages 8-10, etc. There are ideas for activities in the community, day trips that can be taken, games, activities, music, TV shows and movies to watch, etc. The ideas and activities aim to make those interactions fun and engaging for both parents/guardians/teachers and children in a way that is comfortable and “fits”.

The site encourages schools to particpate by providing lesson plans for a variety of subject areas that have been developed as examples and suggestions (www.talkwithourkidsaboutmoney.com)

Generally, you don’t have to be a money expert when great websites are available to provide tips and activities to help your child learn money skills and good money habits. However, I have also gathered 10 rules that you might want to consider when having money conversations with your children or students.

10 rules for talking to kids about money

- Start slow.

- Start early. Age approriate financial education can start in kindergarten but children are prime to start learning about money between the ages of 8 and 12.

- Keep it simple. There are ways to pass along general financial principals without getting bogged down in the details

- Be honest. Parents often have regrets about money. If so, your children can learn from them

- Set financial goals and budgets which will remind your kids that sacrifices sometimes need to be made to reach goals

- Conversations are more effective than lectures.

- Walk the Talk. The best way to teach is by example.

- Regardless of how ill prepared parents may feel about money, passing on ingnorance to financial matters can lead to disaster

- Emphasize the importance of giving back by helping enable your kids an opportunity to participate in giving.

- Talking with your kids about money is an ongoing dialogue not a one time conversation. Keep the conversation going.

Sound financial lessons are so important. If you want children to feel confident and competent they need to understand the value of a dollar and that that means starting to talk about good financial habits at a young age. Having meaningful conversations about money can empower children for a lifetime.