Problems in dealing with digital property after the death of a loved are becoming all that more common given the digital age in which we live. Based on the fact that way too many Canadians don’t have an up to date will to take consideration of their financial assets; it’s even more rare to hear of individuals giving adequate consideration to their digital assets. Thus, I was surprised that the late great TV host Anthony Bourdain who died in June, wrote in his will that his estranged wife should dispose of his frequent flyer miles and other possessions in a way she believed woud be what he wanted. Well, that was kinda helpful. Hopefully she also was provided with his card and access information.

Loyalty points are just one example of digital assets that can be of great value in an estate. The value of unredeemed loyalty points reached $16 billion in Canada last year as memberships have grown some 68% over the past 5 years to an average of 12.3 cards per person! Some 93% of Canadians report membership in at least one program. That would lead one to conclude that the last McAfee (the internet security company) estimate of the average individual owning $35,000 in digital assets in 2013 needs to be re-visited.

Digital assets come in many forms:

- Information or data stored electronically or online like movies, music, videos, ebooks, games and digital photos

- Online accounts such as email and communications as well as social media profiles and blogs especially those that generate revenue

- Domain names

- Digital Intellectual property like copyrighted digital materials, registered trademarks, and code you may have written

- Computing hardware like computers, hard drives, flash drives, tablets, smart phones, digital music players, e-readers or digital cameras

- Accounts used to manage money and hold money or credits like PayPal, loyalty rewards programs or video gaming accounts

The onus is really on the member to leave written notes to their executor dictating what should be done with all of their assets including digital assets. However, many of these digital assets come with complicated terms of service agreements which can be frustrating or impossible for loved ones to access. There is no industry standard and depending on where you live, some agreements might even put loved ones in legal trouble based on anti-hacking or privacy statutes after their loved ones die.The issue is more about privacy-since privacy rights continue after death. The other real problem is that people do die (!)

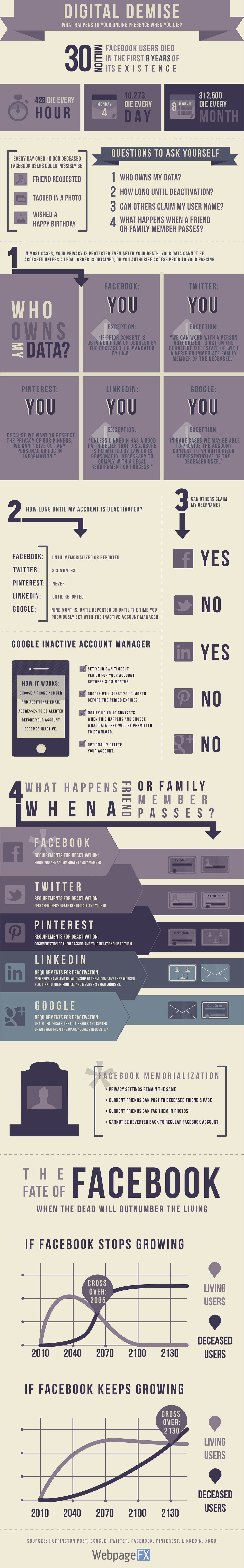

Estimates are that as many as 10,275 Facebook users and 5.700 iTunes owners die each day so dealing with those users’ digital property is an issue. The story a few years ago about a widow in Victoria trying to access games on her deceased husband’s iPad highlighted the problem. Shortly after Peggy Bush’s husband died , the 72-year-old, tried to play games her husband had purchased before his death. Nothing short of a court order was good enough to be able to access those iTunes games including a death certificate or the will until CBC Go Public stepped in and Apple stepped up.

As far as loyalty rewards programs a recent Canadian Press survey noted the following programs that permit the transfer of points or miles:

- Air Miles, Aeroplan, Esso, WestJet Airlines, Porter Airlines, Hudson’s Bay, Sobeys

- The 5 largest banks

- US based hotel chains Hilton, Marriott and Starwood

- PC Optimum, and Metro don’t allow you to transfer but will allow you to use a deceased member’s card

With respect to other digital property stored online, the real problem is that digital property is unique from other property owned by a loved one. While users of digital property own the material online for the most part, access to it is controlled by providers like Apple. Providers set the rules when it comes to accessing what we put online and the content purchased. One solution is that providers should offer clearer, “plain speak” policies dealing with digital property and access. Most users I suspect do not read 28 pages or so of terms and conditions

Canadian laws need to be more clear about who owns or controls what is put online after someone dies. In the US, the Uniform Fiduciary Access to Digital Assets Act will hopefully solve the problem for Americans using the concept of “media neutrality“. Such legislation would give the account holder the power to decide what happens to his or her digital assets in the same way they do for physical or financial assets. Delaware was the first state to take the lead and enact such legislation but many other states have introduced such legislation for consideration. While I’m not aware of any such legislation being contemplated here in Canada but I’m an accountant and certified financial planner and not a lawyer.

Failing such legislation being put in place there are steps that can be taken to secure your digital property for your loved ones. Consider these key to do’s to safeguarding your hard earned digital property:

- Plan Ahead – make a “digital estate plan” comprised of a list of important passwords and online accounts and specify what should be done with each of those accounts if you were to become incapacitated or die.

- Name or suggest a digital “executor or trustee” who can assist the executor designated in your will to follow the wishes laid out in your digital estate plan

- Keep your digital estate plan/list up to date – regularly review your list for any changes (and additions) you have made. As we know, many online forums now require you to change your password regularly.

- Store and share – store your list in a secure but accessible location and let family members/executors know how to access that list. Don’t make the mistake of listing all your online accounts and passwords in your will or power of attorney as they can’t be guaranteed to remain secure

- Backup – ensure you back up your digital assets if they are stored online; backup data to a local computer or a USB or similar storage device on a regular basis.

- Estate planning-work with an estate lawyer to update your wills and powers of attorney to include digital property. Refer to the information in #1 above in a separate document (not in your actual will due to privacy concerns) and provide consent /authorizations so that your loved ones/executors can deal with them appropriately. This would include password resets or recoveries as well as answers to security questions.

If you are one of the 44% of Canadians without a will maybe thinking about all of those hard earned miles and rewards or playlists going to waste will motivate you to finally get your estate in order. Maybe?

Digital-Demise